Indiana Sales Tax Calculator

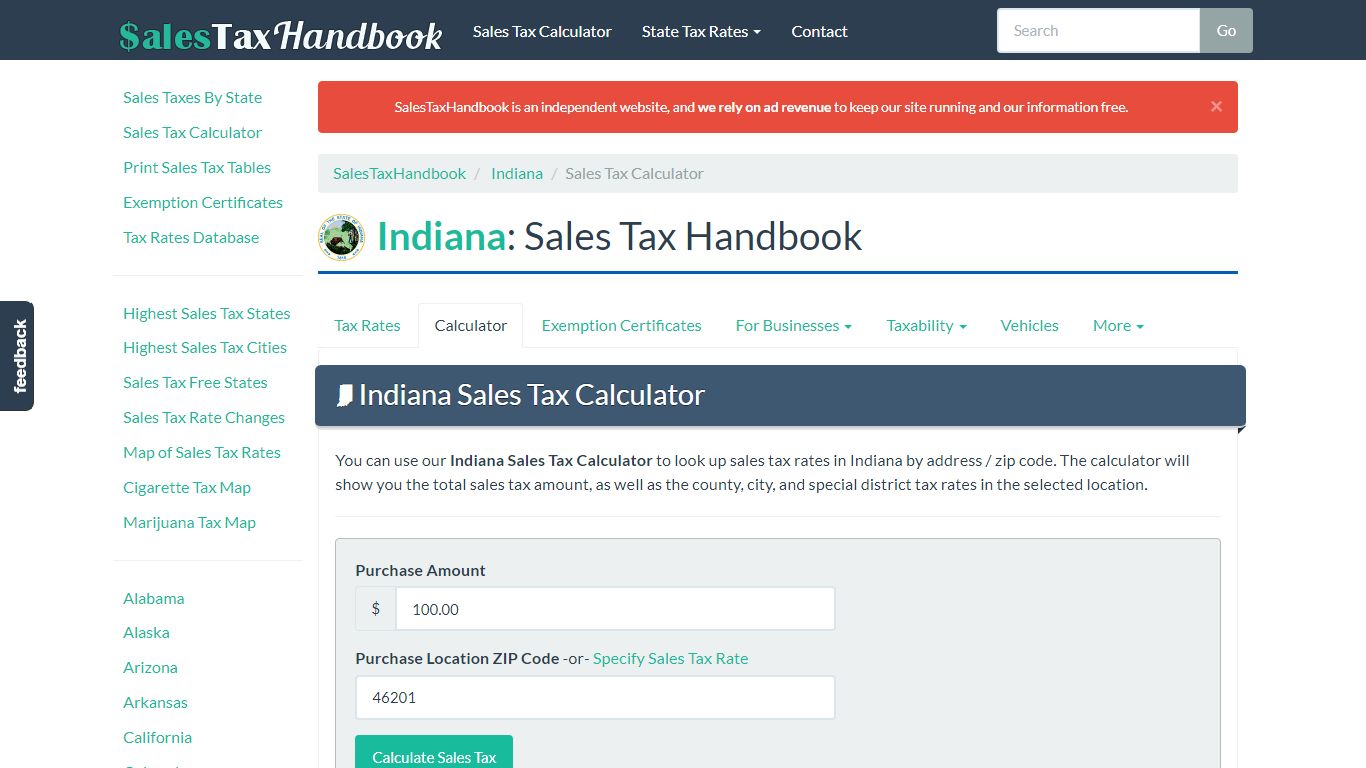

Indiana Sales Tax Calculator - SalesTaxHandbook

Indiana Sales Tax Calculator You can use our Indiana Sales Tax Calculator to look up sales tax rates in Indiana by address / zip code. The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location. Purchase Amount $ Purchase Location ZIP Code -or- Specify Sales Tax Rate

https://www.salestaxhandbook.com/indiana/calculator

Indiana Sales Tax Calculator - Tax-Rates.org

Just enter the five-digit zip code of the location in which the transaction takes place, and we will instantly calculate sales tax due to Indiana, local counties, cities, and special taxation districts. Please note that special sales tax laws max exist for the sale of cars and vehicles, services, or other types of transaction.

https://www.tax-rates.org/indiana/sales-tax-calculator

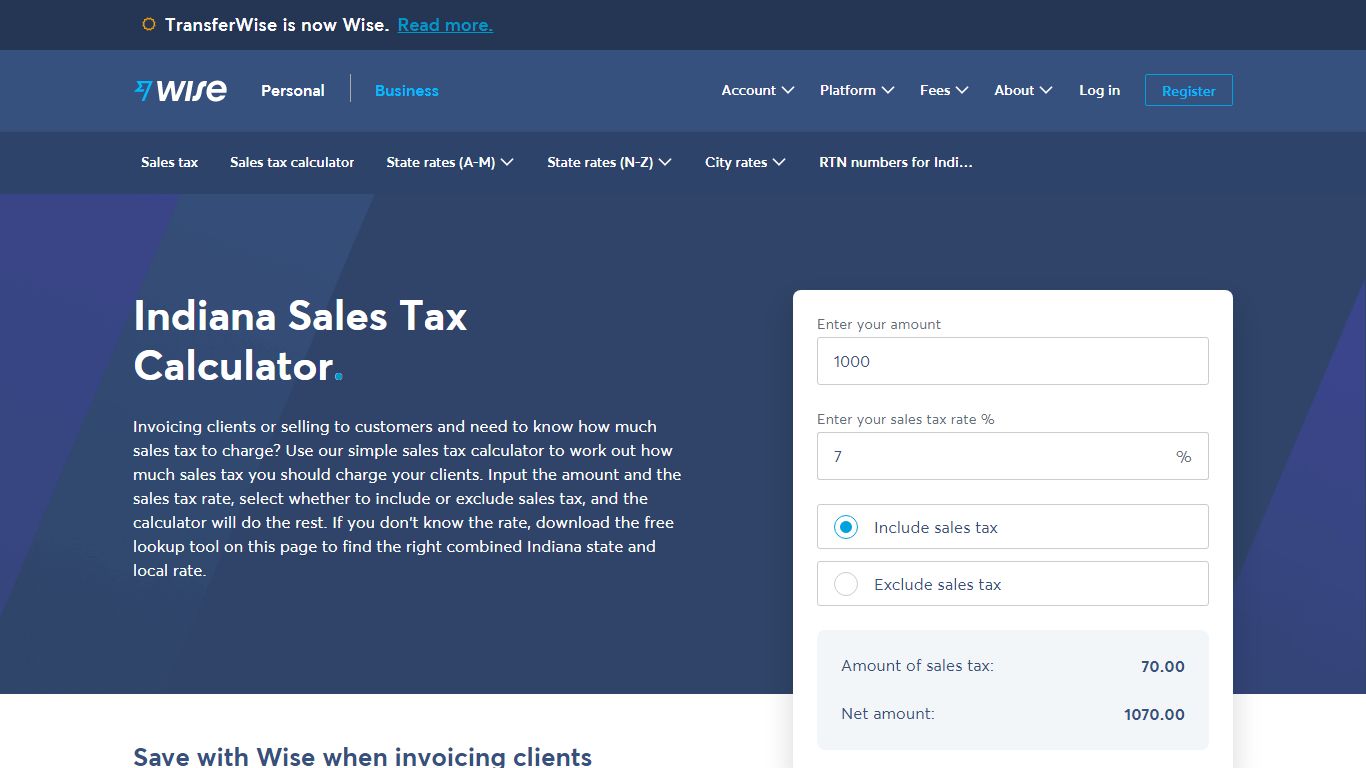

Indiana Sales Tax | Calculator and Local Rates | 2021 - Wise

Indiana Sales Tax Calculator. Invoicing clients or selling to customers and need to know how much sales tax to charge? Use our simple sales tax calculator to work out how much sales tax you should charge your clients. Input the amount and the sales tax rate, select whether to include or exclude sales tax, and the calculator will do the rest.

https://wise.com/us/business/sales-tax/indiana

Indiana Sales Tax Rate & Rates Calculator - Avalara

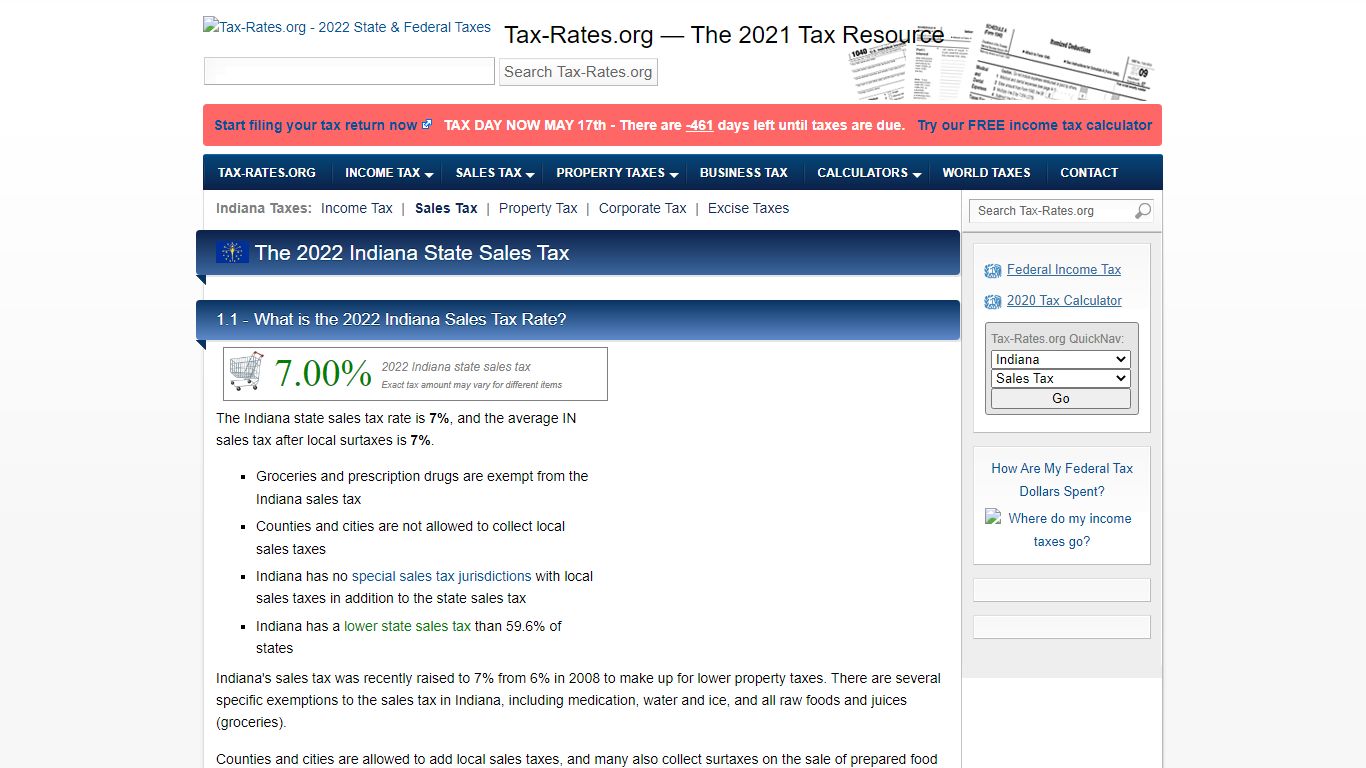

For more accurate rates, use the sales tax calculator. City Sales Tax Rates County Sales Tax Rates Indiana sales tax details The Indiana (IN) state sales tax rate is currently 7%. Because of its single state tax rate, Indiana is one of the few states that does not require extensive maintenance.

https://www.avalara.com/taxrates/en/state-rates/indiana.htmlSales Tax - DOR

Sales Tax If your business sells goods or tangible personal property, you’ll need to register to collect a seven percent sales tax. This registration allows you to legally conduct retail sales in the state of Indiana. Once your registration is completed and processed, you’ll be issued a Registered Retail Merchant Certificate (RRMC).

https://www.in.gov/dor/business-tax/sales-tax/

Indiana Sales Tax Rate - 2022

Indiana Sales Tax Calculator Purchase Details: $ in zip code Enter the zip code where the purchase was made for local sales tax Whenever you make a purchase at a licensed Indiana retailer, your sales tax will be automatically calculated and added to your bill. To lookup the sales tax due on any purchase, use our Indiana sales tax calculator . 1.5 -

https://www.tax-rates.org/indiana/sales-tax

Indiana Sales Tax Rate - 2022

Indiana Sales Tax Calculator Purchase Details: $ in zip code Enter the zip code where the purchase was made for local sales tax Whenever you make a purchase at a licensed Indiana retailer, your sales tax will be automatically calculated and added to your bill. To lookup the sales tax due on any purchase, use our Indiana sales tax calculator . 1.5 -

https://www.tax-rates.org/salestax.php?state=Indiana

DLGF: Taxpayer Calculators

The Department of Local Government Finance (DLGF), in partnership with the Indiana Business Research Center (IBRC) at Indiana University, created the below tax bill projection tools for Indiana taxpayers. These tools will allow the taxpayer to enter their property's assessed value and possible deductions to see a range of tax bill estimates.

https://www.in.gov/dlgf/understanding-your-tax-bill/taxpayer-calculators/

Indiana Income Tax Calculator - SmartAsset

Indiana Income Tax Calculator Overview of Indiana Taxes Indiana has a flat statewide income tax. In 2017, this rate fell to 3.23% and remains there through the 2021 tax year. However, many counties charge an additional income tax. The statewide sales tax is 7% and the average effective property tax rate is 0.81%.

https://smartasset.com/taxes/indiana-tax-calculator